Kevin Warsh isn’t just another former Federal Reserve official. He’s a guy who went from advising Wall Street megadeals to helping steer the U.S. economy through its worst crisis since the Great Depression—all before turning 40. Oh, and he’s married to a billionaire.

Let’s break down his life, career, controversies, and net worth in a way that doesn’t feel like a Wikipedia dump.

From Upstate New York to the Federal Reserve: The Early Years

Born on April 13, 1970, in Albany, New York, Kevin Maxwell Warsh grew up in Loudonville, a quiet suburb. His parents, Judith and Robert Warsh, raised him with a strong work ethic, something he later credited for shaping his understanding of the “real economy.”

After graduating from Shaker High School, Warsh headed to Stanford University, where he earned a Bachelor’s in Public Policy in 1992, focusing on economics and political science. Then came Harvard Law School, where he graduated cum laude in 1995. But he didn’t stop there—he also took finance courses at MIT Sloan and Harvard Business School, sharpening his expertise in market economics.

Wall Street to the White House: The Rise of a Financial Power Player

Trump looking at Kevin Warsh for Fed Chair…

He’s a hawk and was against a lot of the policy post-GFC. Called QE “reverse Robin Hood”.

Trump likely wants to play into a strong Dollar and reducing the debt, but don’t think they told him what that might mean for the stock market. pic.twitter.com/Phvzc36wEU

— Geiger Capital (@Geiger_Capital) March 17, 2024

Warsh kicked off his career in 1995 at Morgan Stanley, working in mergers and acquisitions. By 2002, he had climbed to executive director, advising major corporations on billion-dollar deals.

Then, George W. Bush came calling. From 2002 to 2006, Warsh served as Special Assistant to the President for Economic Policy and Executive Secretary of the National Economic Council. His job? Advising Bush on everything from banking regulations to financial crises. He was also the White House’s main link to Wall Street, a role that set him up for his next big gig.

The Youngest Fed Governor in History (And a Crisis Firefighter)

In 2006, at just 35 years old, Warsh was nominated to the Federal Reserve Board of Governors—the youngest ever. Critics, including former Fed Vice Chair Preston Martin, thought he was too inexperienced. But Ben Bernanke, then-Fed Chair, later admitted Warsh’s Wall Street connections and political savvy were invaluable during the 2008 financial meltdown.

Warsh’s Role in the 2008 Crisis

- Wall Street’s Inside Man: Warsh became Bernanke’s go-to guy for dealing with banks. He even tried (and failed) to broker mergers between Citigroup and Goldman Sachs, and Wachovia and Goldman Sachs.

- Saved Morgan Stanley: After getting a conflict-of-interest waiver (he used to work there), Warsh helped convert Morgan Stanley into a bank holding company, giving it access to Fed lifelines and saving it from collapse.

- Inflation Warnings (That Were Wrong): Throughout 2008, Warsh kept warning about inflation risks—even as the economy was spiraling into deflation. Bernanke later admitted in his memoir that this was frustrating.

Post-Fed Life: Stanford, Corporate Boards, and Trump’s Fed Drama

Another major Trump vs. Powell development:

The president has reportedly been discussing firing the Fed Chair for months now

He’s held talks with former Fed Governor Kevin Warsh about replacing Powell as recently as February

Powell’s term doesn’t end until May 2026 pic.twitter.com/95jykq3hdH

— Morning Brew ☕️ (@MorningBrew) April 17, 2025

After leaving the Fed in 2011, Warsh didn’t fade into obscurity. Here’s what he’s been up to:

- Hoover Institution Fellow: He’s now a distinguished visiting fellow at Stanford, where he lectures on economics.

- Corporate Boards: He sits on the board of UPS and Coupang Inc. (a South Korean e-commerce giant), where he owns 459,102 shares worth about $10.1 million.

- Trump’s Fed Whisperer: In 2025, reports surfaced that Donald Trump had consulted Warsh about firing Fed Chair Jerome Powell. Warsh reportedly advised against it, but Trump kept publicly trashing Powell anyway.

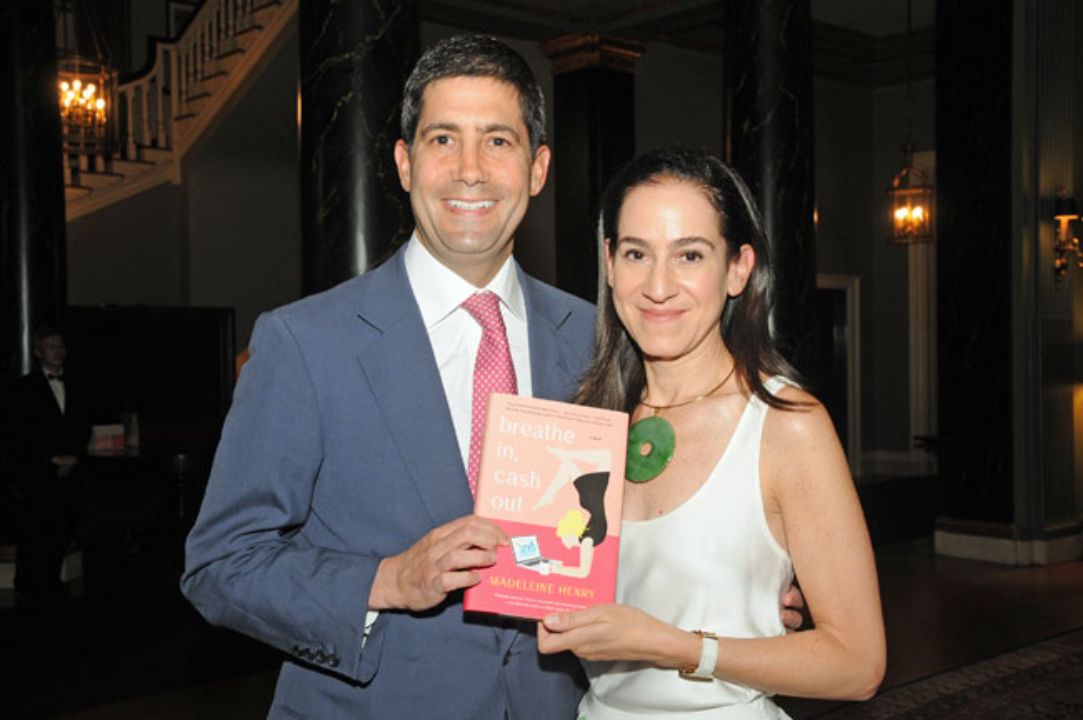

Personal Life: Married to a Billionaire Heiress

In 2002, Warsh tied the knot with Jane Lauder, granddaughter of Estée Lauder and heir to the cosmetics empire. Jane, worth $1.46 billion, is a former chief data officer at Estée Lauder and now runs its Clinique brand.

The couple lives in Manhattan, where Jane collects contemporary art and runs marathons. Meanwhile, Warsh splits his time between academia, corporate boards, and occasional political drama.

Net Worth: How Rich Is Kevin Warsh?

Estimates vary, but here’s the breakdown:

- 10.1 million: This comes from his Coupang stock holdings (459,102 shares as of February 2025).

- $504,208: Some reports peg his net worth lower, based on older SEC filings.

- Family Wealth: While not confirmed, marrying into the Lauder fortune means his household net worth is easily in the billion-dollar range.

Controversies and Unpopular Opinions

- QE Critic: Warsh has long warned that quantitative easing (QE) distorts markets. In a 2024 panel, he argued it leads to “misallocations of capital”—a view that puts him at odds with many economists.

- Inflation Missteps: His insistence in 2008 that inflation was a bigger threat than deflation turned out to be dead wrong.

- Political Ties: His closeness to Trump and Republican circles has made him a polarizing figure in central banking.

Final Thoughts: A Unique Figure in Finance

Kevin Warsh isn’t your typical economist. He’s a Wall Street insider turned policymaker, a crisis firefighter, and a guy who married into one of America’s richest families. His career has been a mix of bold moves, miscalculations, and high-stakes influence—and at 55, he’s still shaping economic debates today.

Whether you agree with his views or not, one thing’s clear: Warsh’s story is far from over.